Partnership will support Latin American and Caribbean fintechs who will benefit from faster times-to-market and onboarding

Visa Partners with Mexican Fintech Enabler Cacao to grow Digital Payments in Latin America and the Caribbean

MIAMI, September 28th, 2020 – Visa announced a five-year partnership today with Mexico-based Cacao - known as a “fintech enabler” - for Latin America and the Caribbean. The partnership will support Cacao in expanding its operations to key markets in the region as it enables fintechs of all sizes to provide Visa capabilities, drive innovation and accelerate time-to-market in the financial and digital payments space. Visa will be the preferred partner for Cacao as it establishes operations throughout Latin America and the Caribbean. Colombia, Chile, Costa Rica, the Dominican Republic, Panama, and Peru are the first countries slated for Cacao’s expanded operations.

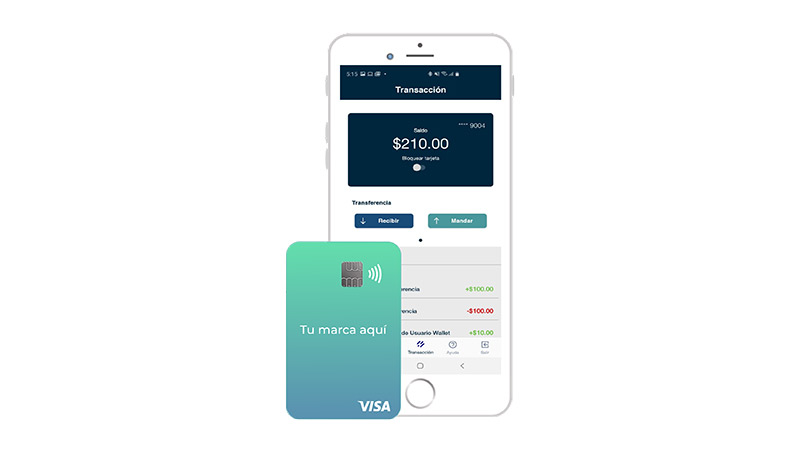

Cacao offers an integrated, full-stack solution that enables fintechs to accelerate their go-to-market efforts in launching prepaid, debit, and credit cards, while relying on Cacao’s scalable, reliable, and secure platform. By leveraging Cacao’s partnership with Visa, fintech companies can be rifle-focused on developing, deploying, and scaling card programs without having to worry about the complexity, cost, and time of setting up in-house card issuance capabilities.

Cacao’s proven expertise and track record of enabling card programs for various fintechs of all shapes and sizes, will benefit the entire ecosystem – from early-stage to multinational fintech companies. “Visa is constantly striving to enable innovation, speed, and agility to create next-gen customer experiences, while ensuring we have the capabilities in place to accelerate the growth of fintech and startups across Latin America and the Caribbean. Our partnership with Cacao highlights our commitment, as a technology company, to support the evolution of the financial services industry in the region,” said Arnoldo Reyes, Vice President of Digital Partnerships, Fintech and Ventures for Visa Latin America and the Caribbean. “We believe fintech companies are critical to accelerating access to a wide range of financial services and capabilities, enabling new consumer and merchant payment experiences, and driving digital inclusion. We look forward to working with the entire Cacao team in the coming months as we work to support fintechs across the region.”

Solving for Fintech challenges

A major hurdle for fintechs to bring their products to market is gaining regulatory approval and licensing in the countries where they operate. This is especially true for new or early stage fintechs that do not have the resources nor scale to navigate the many requirements. At the same time, Visa has risk safeguards in place that can also be challenging for smaller fintechs to traverse in order to gain Visa primary license status. Fintech companies need plug-and-play solutions typically provided by sponsoring financial institutions (BIN-Sponsors), issuer processors, and program managers.

Cacao is a Licensed Fintech in Mexico and Visa BIN-sponsor and one of the first to offer a Fintech-as-a-Service model. Cacao customers leverage these credentials and can also benefit from bespoke modules according to their needs, ranging from fraud prevention and call centers to automated accounting.

About Visa Inc.

Visa Inc. (NYSE: V) is the world’s leader in digital payments. Our mission is to connect the world through the most innovative, reliable and secure payment network - enabling individuals, businesses and economies to thrive. Our advanced global processing network, VisaNet, provides secure and reliable payments around the world, and is capable of handling more than 65,000 transaction messages a second. The company’s relentless focus on innovation is a catalyst for the rapid growth of digital commerce on any device for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network and scale to reshape the future of commerce. For more information, visit About Visa, visa.com/blog and @VisaNews.

About Cacao

From Mexico to Latin America. Cacao leads the fintech enabling market in Mexico, sponsoring over 80% of the market. Since its early stage, Cacao’s unique fintech as a service model enabled the market, placing Mexico in one of the most important countries in the Fintech industry. “Go to market” is one of Cacao’s main drivers, which also spans from processing, card issuing, bin sponsoring, credit card platform, or the full stack! Cacao is an innovative company that will enable very important programs in the rest of the region.###